Research Report | February 13, 2023

Small Businesses Awarded Record $159 Billion from Federal Government in 2022

Despite record awards, the number of small business recipients continues to decline and many groups are falling behind

Key Takeaways

- Small businesses received a record $159 billion in Federal government contracts in fiscal year 2022

- The number of small businesses receiving prime government contracts continued its long-term decline to fewer than 60,000

- Despite Biden administration efforts, small businesses owned by women and many minority groups saw a flat or declining share of contracts

- The average small business contractor was awarded $2.7 million in 2022, a 9% increase from the prior year, representing a strong opportunity for small businesses able to navigate the contracting process

- Recently announced plans by the Department of Defense to strengthen the small business defense base are positive, but Congressional support would greatly bolster efforts

Overview of Government Small Business Contracting

Robust small business activity is critical to the federal government obtaining access to new technology and ideas, supporting economic growth, and securing the unique robustness of the United States’ defense base. The involvement of small businesses in the government procurement process also increases the number of options and level of competition for contracts, ultimately providing the American taxpayer with better services at better prices.

However, there are many barriers to small businesses contracting with the federal government, including complex regulations, confusing points of entry, contract vehicles that limit competition, and bundling that benefits large incumbent contractors.

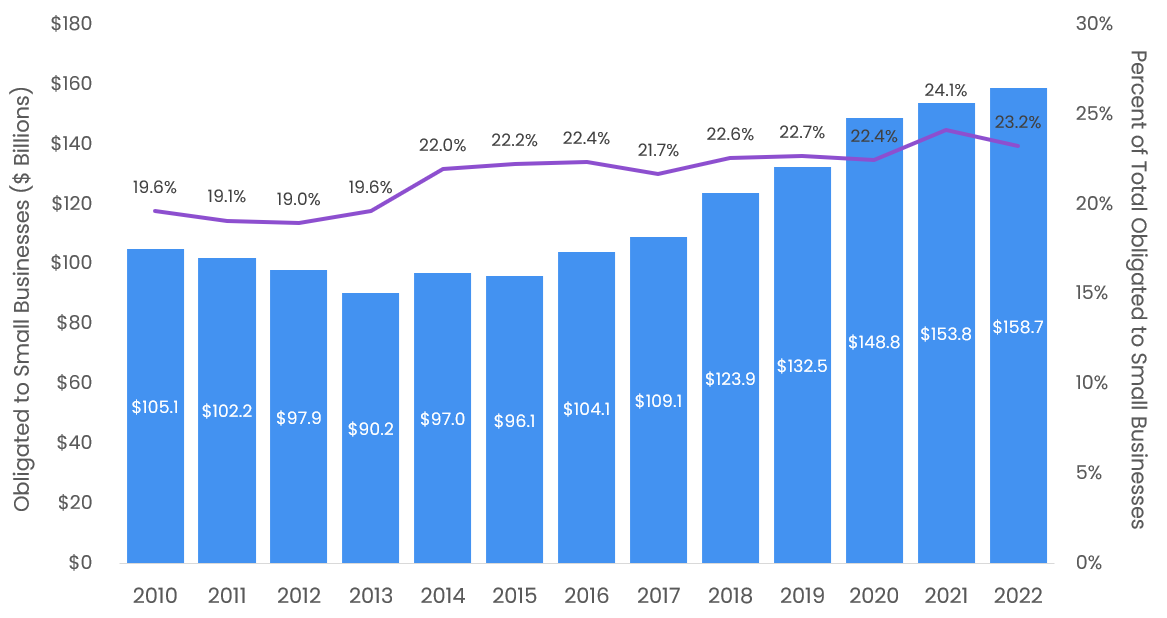

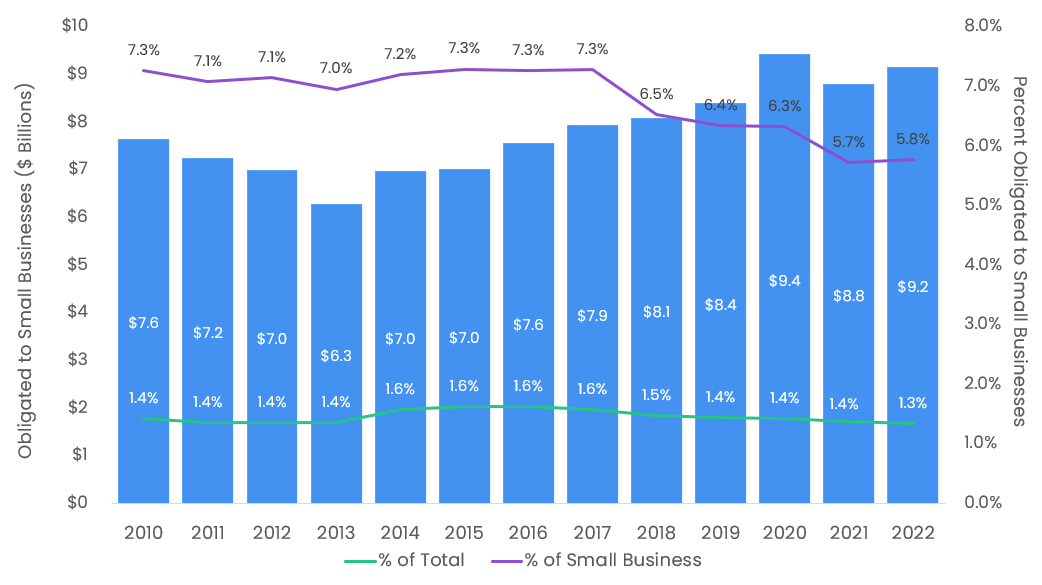

Small Business Awards Reached Record in 2022 - Total Number of Businesses Declined

$158.7 billion was awarded directly to small businesses in government fiscal year 2022, an increase of 3% over the prior year and the highest level ever recorded. In total, $682.6 billion was awarded in government contracts in 2022. The total percentage of disclosed contracts going to small businesses decreased slightly from 24.1% in 2021 to 23.2% in 2022.

Federal Government Prime Small Business Contracts

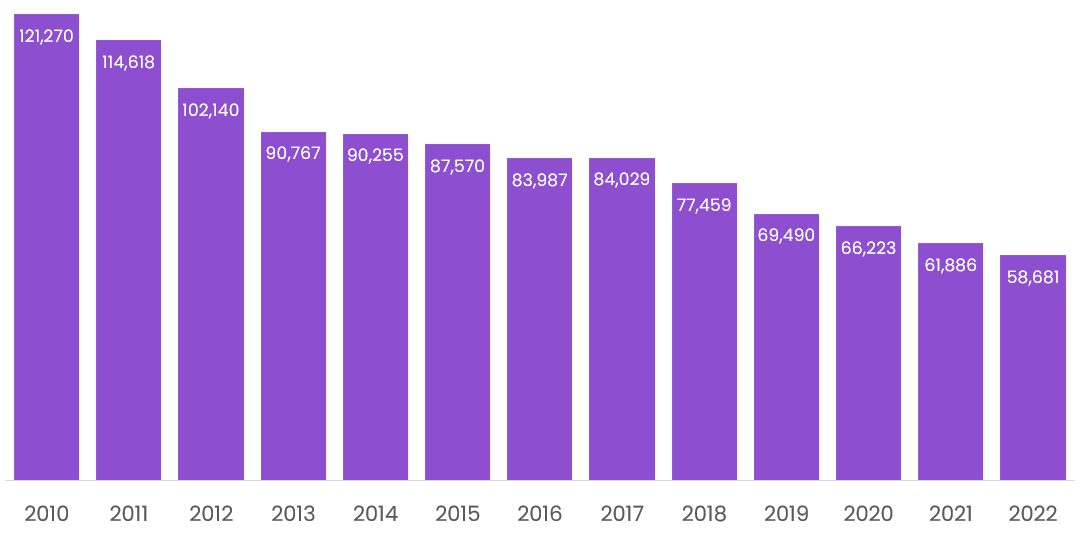

The number of small businesses receiving awards continued its long-term decline to only 58,681 in 2022, fewer than half the number that received awards 2010. There are more than 400,000 companies with active registrations to perform contracts with the federal government, so why does the number of small businesses winning contracts continue to decline?

Major drivers include increased use of contract vehicles available to a limited number of firms, expanding regulations (such as cybersecurity requirements), and contract bundling that benefits larger firms and incumbents. Moreover, in its small business efforts, the government has put almost exclusive focus on increasing the dollars being awarded to small businesses rather than increasing the number and diversity of small businesses winning contracts.

Number of Small Businesses Receiving Contracts

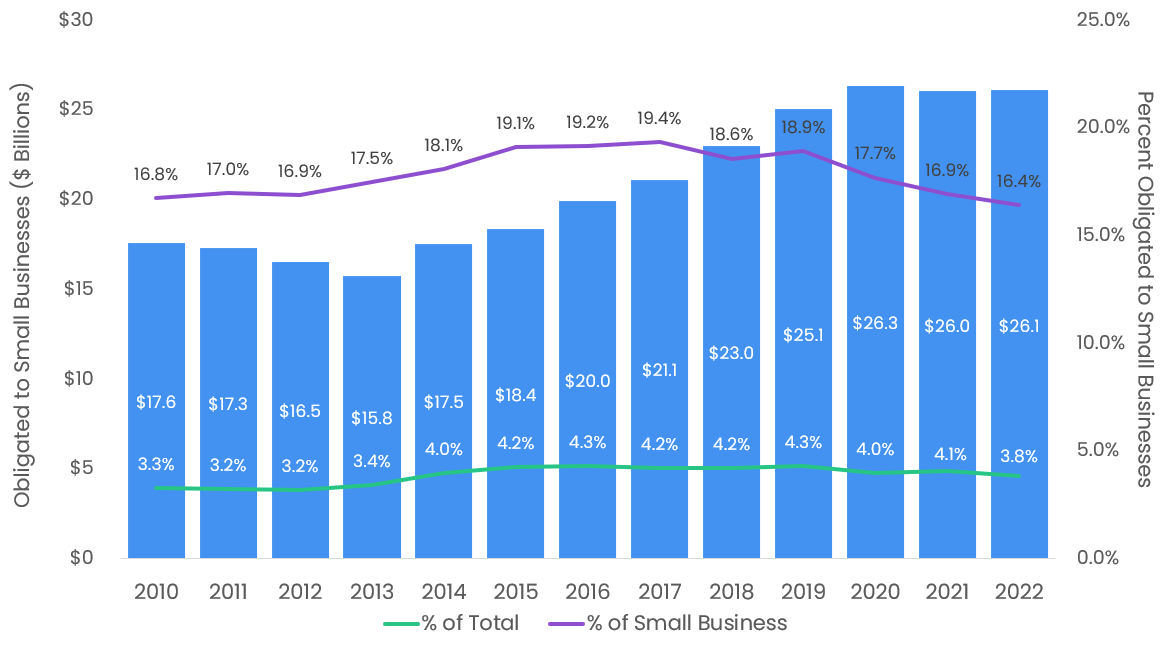

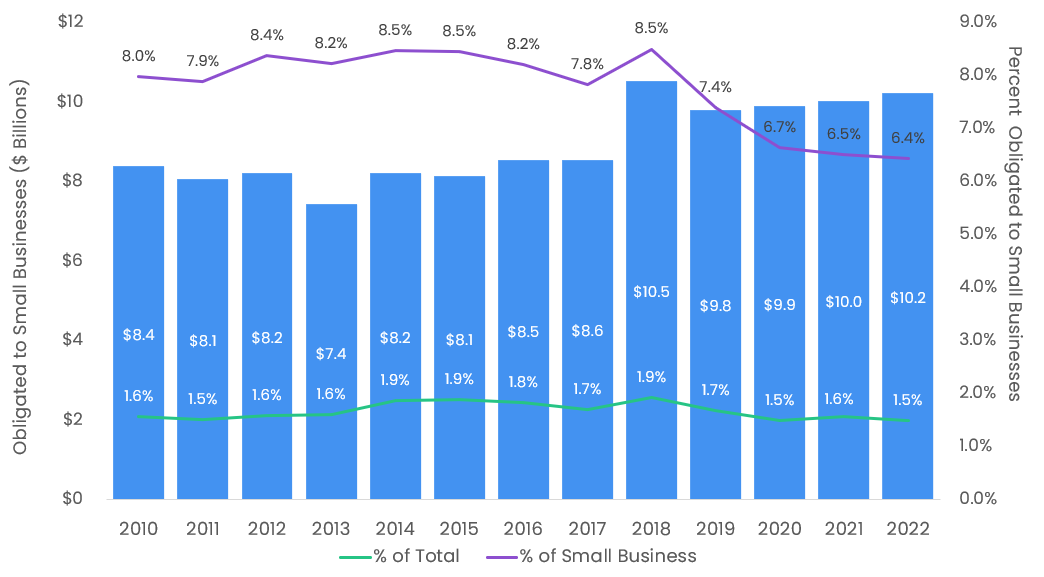

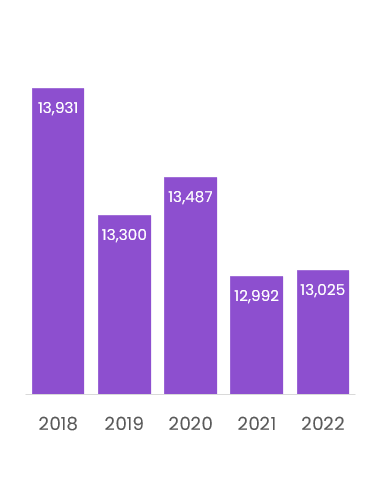

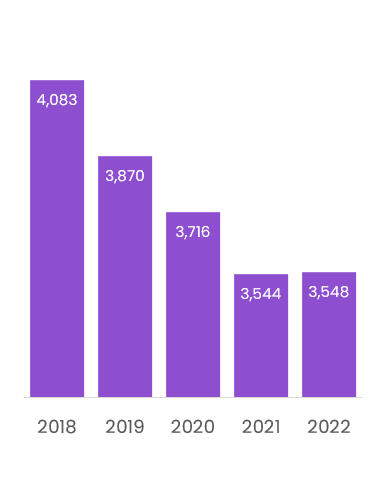

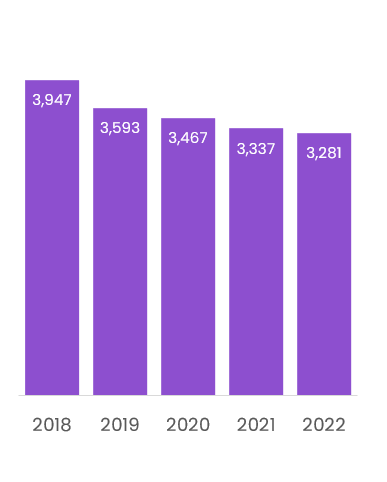

Women- and Minority-Owned Small Businesses Not Gaining Traction

The Biden Administration has made increasing the level of government contract spending going to women- and minority-owned businesses a priority, starting with Executive Order 13985 in January 2021. During fiscal year 2022, it released further reforms with a goal of increasing spending received by these groups.

However, while the total dollars received by women-owned, Black-owned, and Hispanic-owned small businesses all increased in 2022, the year saw decreasing or stagnating awards as a percentage of total contracts, awards as a percentage of dollars awarded to small businesses, and in the total number of small businesses receiving awards.

Women-Owned Small Business Prime Contract Awards

Black-Owned Small Business Prime Contract Awards

Hispanic-Owned Small Business Prime Contract Awards

Number of Small Businesses Receiving Prime Contracts

Women-Owned

Black-Owned

Hispanic-Owned

Of other groups tracked, Service-Disabled Veteran Owned Small Businesses were awarded $26.8 billion (3.9% of total awards), Native American Owned Small Businesses were awarded $18.5 billion (2.7%), Subcontinent Asian / Indian American Owned Small Businesses were awarded $10.1 billion (1.5%), and Asian-Pacific American Owned Small Business were awarded $7.3 billion (1.1%) in 2022.

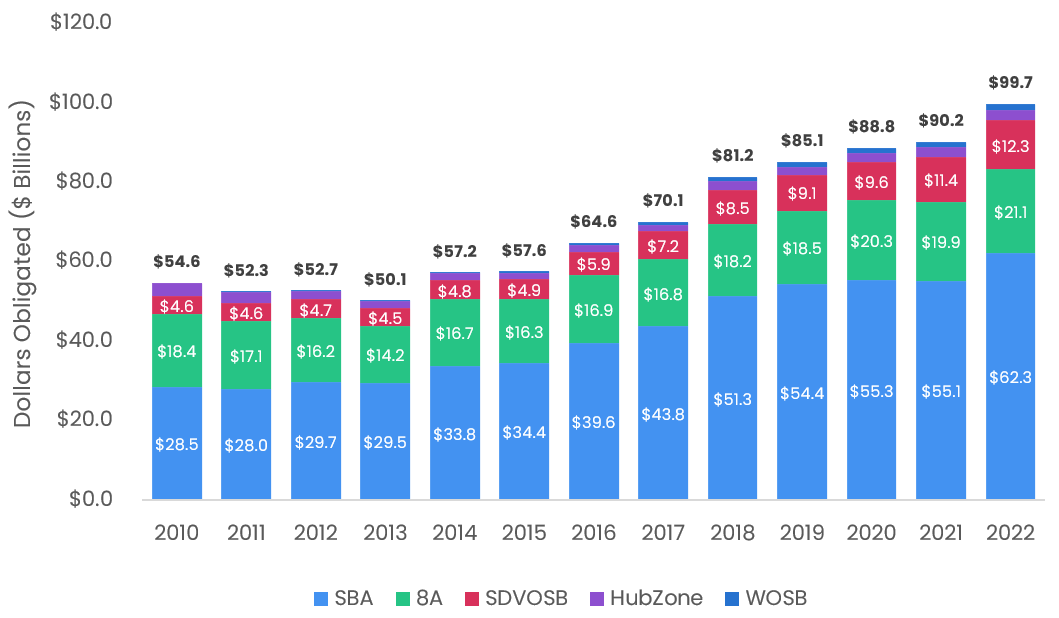

Small Business Set-Aside Trends

The federal government limits competition on certain contracts to small businesses to promote small business involvement in government contracting. These "set-asides" are one of the primary tools that the government has to meet its small business contracting objectives.

Generally, all government contracts under $150,000 are set aside for small businesses, and if there are two or more small businesses capable of completing the contract, the contract is set aside solely for small businesses. Some set-asides are open to all small businesses, while others are only available to those participating in specific Small Business Administration (SBA) assistance programs.

In fiscal year 2022, total contracts set-aside for small businesses increased sharply to $99.7 billion, a new record. Small businesses increasingly rely on set-asides to win awards with approximately 63% of all small business awards including a set-aside in 2022 versus 52% in 2010. While set-asides are an important tool for small business contractors, in the long-run if companies are to grow beyond small business status, they must be able to win without relying on set-asides.

Small Business Set-Asides By Year

What Small Businesses Can Do to Win Federal Contracts

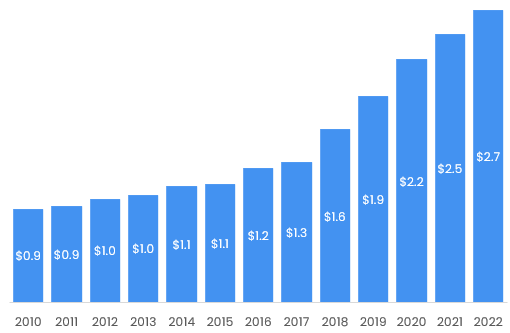

Average Awarded to Each Small Business ($M)

Federal government contracts can be extremely valuable for small businesses. The corollary to the decreasing number of contractors is that the average value of contracts awarded to businesses successfully able to navigate the contracting process has increased significantly - the average small business received $2.7 million in 2022. Moreover, many federal government contracts are three to five years in length, providing long-term stability to growing businesses.

Additionally, despite the occasional government shutdown or budget cut, the credit quality and the spending of the federal government is generally very strong and predictable, including during times of economic uncertainty. With a rapidly aging federal workforce, the demand for private business to support federal activity is unlikely to wane any time soon.

There are several steps that small businesses can take to win more federal government work, rather they are a dedicated government contractor, are currently solely private-sector focused, or are a sole proprietor.

Build Partnerships with Established Contractors

We estimate that more than $100 billion was awarded to small business subcontractors on government contracts in 2022, approximately two-thirds of what was awarded directly by the government. Many government contracts awarded to large contractors have subcontracting plans that require a certain percentage of work be subcontracted out to small businesses with certain size and socioeconomic characteristics.

Finding and building partnerships with experienced prime government contractors can help to build the experience needed to win government contracts directly while earning predictable revenue. The government also offers a number of programs including the Small Business Administration and Department of Defense Mentor Protégé programs that can formally pair small businesses with more experienced contractors.

Target Easier Agencies and Services

As shown in the tables at the end of this report, there are significant differences in how easy it is for small businesses to win awards at certain federal agencies and with certain types of work. While obviously some of the differences come down to the types of work it is feasible for small businesses to perform (it is easier for a small business to provide computer programming services than to manufacture guided missiles), it is generally easier to win contracts in areas where the government is more accustomed to working with small businesses.

Additionally, some agencies such as the National Park Service and the National Oceanic and Atmospheric Administration are typically significantly easier to enter as a first-time contractor than others like the Veterans Health Administration or Drug Enforcement Agency.

Take Full-Advantage of Available Set-Asides and Programs

Many small businesses do not take full advantage of the contract set-asides available to them. For example, there are currently 6,400 companies registered in the government's 8(a) program, which provides training and technical assistance and access to special set-aside contracts for companies owned by "socially and economically disadvantaged individuals".

However, we estimate that there are at least 60,000 companies actively registered as contractors with the federal government self-certifying as one of the socially disadvantaged groups eligible for the 8(a) program, that if registered would have access to more than $21 billion that was awarded specifically to 8(a) program members in 2022.

Likewise, while there are nearly 9,000 Women-Owned Small Businesses certified with the SBA, there are more than 70,000 actively registered small businesses self-certifying as women-owned, meaning that most did not have access to $1.5 billion in contracts that were limited in competition to women-owned small businesses in 2022.

Bid Early and Bid Often

While bidding on government contracts can be time consuming and intimidating for small businesses with limited resources, average win rates on new contracts are high. The average government solicitation receives only 4.5 bids and approximately 40% of all competitive solicitations receive fewer than three qualified bids. Monitoring agency contract forecasts can provide notice of when bids will be released months or years before they are officially published by the government on its official procurement website sam.gov, giving time to prepare for upcoming solicitations.

How the Government Can Improve Access to Small Businesses

There are also a number of relatively simple steps the government can take to level the playing field for small businesses while simultaneously increasing transparency and the quality of contracted services.

Publish All Federal Opportunities Publicly

Many government contract opportunities are never widely publicly released because they are only made available to holders of contract vehicles. Publishing the intention to offer a solicitation on a limited basis would enable smaller companies and new contractors to notify government contracting officers of their ability to perform the work, potentially encouraging wider solicitation when appropriate. It would also enable smaller contractors to more easily identify opportunities where they could act as a subcontractor.

Improve Quality of Small Business Contract Forecasts

Under the Business Opportunity Development Reform Act of 1988, government agencies are required to compile and make available forecasts of small business contracting opportunities. Compliance with the spirit of this Act varies widely – while some agencies such the General Services Administration and Department of Homeland Security have strong systems in place and make an effort to provide advanced notice of contracting opportunities, many agencies (particularly within the Department of Defense), only release forecasted opportunities sporadically, and with not nearly enough information to be useful for contractors.

Earlier and higher quality forecasts enable small businesses that do not have developed networks and relationships more time to prepare for solicitations and develop strong teams.

Improve Measurement of Small Business Goals

While the current annual SBA Scorecard is a useful tool, there is clear grade inflation with only one agency receiving a C grade and two agencies receiving a B (versus 21 A or A+) in the 2021 report despite the continual decline in number of small businesses winning contracts. Making the small business targets more ambitious, and adding additional metrics to the scorecard including how easy it is for first time contractors to win contracts, the diversity of work being performed by small businesses (NAICS), the geographic diversity of awards, and the quality of forecasts and solicitations would greatly improve the usefulness of the scorecard.

Minimize Contract Bundling, Add Vehicle On-Ramps

Contract bundling is the combination of multiple contracts or requirements into a single contract. Contract bundling has the potential to benefit the government as larger contracts can be cheaper to award and administer for both the government and contractors. However, bundling often puts contracts at a size and complexity where it is not feasible for small businesses to win. Rule changes to further limit bundling to cases where there is the strongest benefit to the government may in the long-term benefit both the government and the contractor ecosystem.

Moreover, adding on-ramps to contracting vehicles could also greatly benefit new companies in the government market that often have to wait up to five years for contracting vehicles to recompete to gain access.

Expand Special Programs and Small Business Outreach Resources

Congress has historically funded a number of programs specifically to support the small business community. This includes the recently reauthorized Small Business Innovation Research / Small Business Technology Transfer (SBIR/STTR) program, Mentor-Protégé programs, and Defense Research and Development (R&D) Rapid Innovation Program (RIF) (not currently funded). The Department of Defense also sponsors APEX Accelerators (recently rebranded from Procurement Technical Assistance Centers (PTACs)), which can help new government contractors navigate the complexities of government contracting. Increasing funding and support to these programs can directly help the government achieve its small business goals.

Execute the DoD Small Business Strategy

The Department of Defense recently released its highly anticipated Small Business Strategy, which contains a number of strategic objectives to strengthen small business contracting. Many of the objectives in the report would be wisely adopted by civilian agencies and supported by Congress where necessary. While agencies have the ability to make some improvements on their own, others will require Congressional action to bolster funding or make legal changes.Additional Analysis

Breakdown by Agency and NAICS Code

The percentage of contracts going to small businesses varies greatly by federal agency. The table below summarizes the percentage of contracts awarded to small businesses by agency for the largest agencies.

2022 Small Business Obligations by Awarding Agency (% of Total Agency Awards)

| Agency | Awarded Small ($B) |

Percent Small |

| Small Business Administration | $0.50 | 75.7% |

| Department of Agriculture | $6.37 | 64.3% |

| Securities and Exchange Commission | $0.31 | 55.4% |

| Environmental Protection Agency | $0.85 | 54.2% |

| Department of the Interior | $3.44 | 53.1% |

| Department of Commerce | $2.09 | 52.8% |

| Department of Housing and Urban Development | $0.30 | 43.2% |

| Department of Homeland Security | 8.50 | 41.6% |

| Department of Labor | $0.90 | 41.4% |

| Department of the Treasury | $3.50 | 38.0% |

| Department of Transportation | $2.80 | 35.0% |

| Department of Justice | $2.78 | 33.8% |

| Social Security Administration | $0.60 | 31.5% |

| General Services Administration | $5.65 | 28.2% |

| Department of State | $3.15 | 26.9% |

| Department of Health and Human Services | $9.02 | 26.8% |

| National Science Foundation | $0.13 | 23.4% |

| Department of Defense | $89.83 | 21.4% |

| Department of Veterans Affairs | $11.11 | 19.9% |

| National Aeronautics and Space Administration | $2.72 | 16.6% |

| U.S. Agency for International Development | $0.96 | 16.4% |

| Department of Education | $0.38 | 15.7% |

| Department of Energy | $1.74 | 4.2% |

Likewise, there is substantial variation in small business contracts awarded by the type of business.

2022 Small Business Awards by 20 Largest NAICS (% of Total NAICS Awards)

| NAICS | NAICS Description | Awarded Small ($B) |

Percent Small |

| 541519 | Other Computer Related Services | $13.7 | 60.5% |

| 541511 | Custom Computer Programming Services | $9.1 | 50.7% |

| 541611 | Administrative and General Management Consulting | $5.7 | 44.4% |

| 236220 | Commercial and Institutional Building Construction | $12.5 | 44.0% |

| 237990 | Other Heavy and Civil Engineering Construction | $2.5 | 27.7% |

| 541512 | Computer Systems Design Services | $7.9 | 26.8% |

| 541330 | Engineering Services | $11.2 | 26.5% |

| 541715 | R&D in the Physical, Engineering, and Life Sciences | $7.8 | 22.4% |

| 541990 | All Other Professional, Scientific, and Technical Services | $2.2 | 19.0% |

| 324110 | Petroleum Refineries | $2.3 | 17.1% |

| 336413 | Other Aircraft Parts and Auxiliary Equipment Manuf. | $1.8 | 12.6% |

| 561210 | Facilities Support Services | $4.0 | 11.8% |

| 336611 | Ship Building and Repairing | $1.9 | 8.7% |

| 488190 | Other Support Activities for Air Transportation | $6.9 | 8.4% |

| 334511 | Search, Detection, Navigation, and Instrument Manuf. | $0.8 | 5.6% |

| 325412 | Pharmaceutical Preparation Manufacturing | $1.5 | 4.4% |

| 336411 | Aircraft Manufacturing | $0.8 | 2.1% |

| 336412 | Aircraft Engine and Engine Parts Manufacturing | $0.2 | 1.4% |

| 336414 | Guided Missile and Space Vehicle Manufacturing | $0.1 | 0.3% |

Author

Justin SikenFounder of HigherGov

justin.siken@highergov.com

Notes on Methodology

HigherGov Analysis vs. SBA Scorecard

Note that figures in this report will differ from the Small Business Procurement Scorecard released annually by the Small Business Administration (SBA) and other reports released periodically by the SBA and other agencies due to timing and methodological differences, though overall trends will generally be similar. Some of the key methodological differences are noted below:

- HigherGov analysis as of January 31, 2023. The cutoff dates for the SBA scorecards will vary by year and do not account for amendments to historical data after its cut-off dates.

- HigherGov includes all NAICS codes in its analysis. The SBA limits its analysis to the “Top 100 Small Business” NAICS for some analyses.

- HigherGov analysis does not provide any “double credits”. By law, the SBA provides agencies with double credit for certain contract awards in disaster areas and in Puerto Rico. The SBA scorecard also counts Department of Energy first-tier Maintenance and Operations subcontracts as prime contracts.

- HigherGov analysis is performed at the “parent” ownership level. While not specified in its calculation methodology, the SBA appears to count entities at the “child” (subsidiary) level.

Terminology

Note that the term “awarded” as used in this report refers to dollars obligated during government fiscal year 2022 (ending September 30, 2022). Contracts may have started in prior years. Also note that the term "small business" refers to any business that was listed by the awarding contracting officer as being under the NAICS small business size standard for a contract at the time of the award.

Data Sources

HigherGov Analysis, Federal Procurement Data System, System for Award Management, Dynamic Small Business Search, Federal Subaward Reporting System

Other Recent Research

Analysis of 2022 GAO Protest OutcomesAerospace, Defense, and Government M&A Review

CPARS Ratings and Trends (2023)