Special Report | January 20, 2023

CPARS Ratings and Trends (2023)

Evaluation Ratings are Increasing Along with Their Importance

Key Takeaways

- Use of CPARS as a solicitation evaluation criteria has increased significantly

- Frequency of Exceptional and Very Good ratings is increasing, potentially due to rules limiting Lowest Price Technically Acceptable (LPTA) competition

- There are tangible steps contractors can take to improve their CPARS ratings

Overview of CPARS

Introduction

The U.S. Federal government’s Contractor Performance Assessment Reporting System (CPARS) is a tool used by federal agencies to evaluate and track the performance of government contractors. CPARS allows government agencies to document and track contractor performance, including information on the contractor's quality of work and compliance with contract requirements using a consistent and objective method across different contracts and agencies.

Approximately 120,000 CPARS evaluations are performed annually and are generally required on any contract that exceeds $250,000 in value (except for architect-engineering contracts where the threshold is $35,000 and construction contracts where the threshold is $750,000) as well as on a case-by-case basis for smaller critical contracts.

Performance is evaluated in up to seven evaluation areas including Quality, Management, Schedule, Cost Control, Small Business Subcontracting, Regulatory Compliance, and Other. Potential ratings include Exceptional, Very Good, Satisfactory, Marginal and Unsatisfactory.

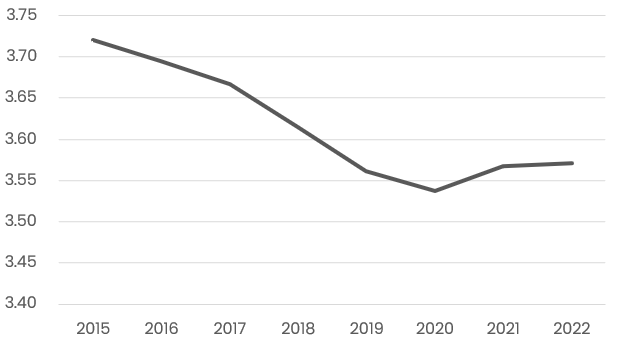

Weighted Average CPARS Rating1

Growing Importance of CPARS Ratings

Past performance evaluations provide a formal mechanism for contractors to receive written feedback. The evaluations are also used by contracting officers in market research, pre-solicitation, and formal solicitation phases to evaluate potential contractors, and thus strong ratings can contribute to a contractor's ability to win and recompete contracts.

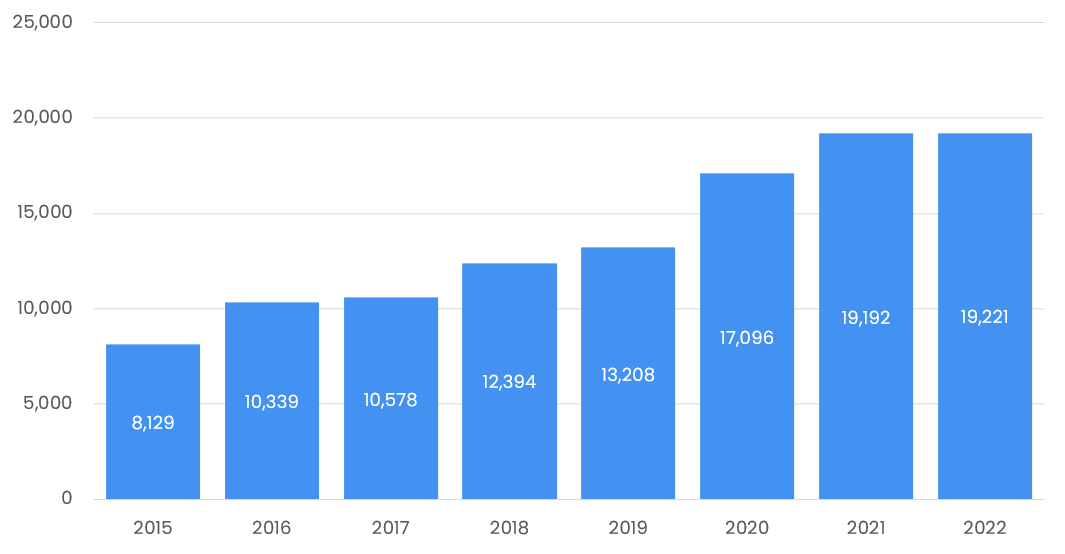

The evaluations are also increasingly used by contracting officers as an explicit past performance criteria in contract solicitations. As shown below, the number of publicly announced pre-solicitations and solicitations that explicitly mention CPARS has increased significantly.

Solicitations where CPARS Evaluations Mentioned as Past Performance Requirement2

Given rating standardization, evaluations can also be critical in establishing credibility when trying to expand into new agencies that might not otherwise have experience with a contractor. Additionally, strong evaluations can help build teaming relationships with prime contractors, and are often a diligence requirement by potential acquirors in corporate acquisitions.

Evaluations are stored for three years following the completion of the contract, so can remain important as an evaluation factor long after the contract is completed.

Trends in CPARS Evaluations

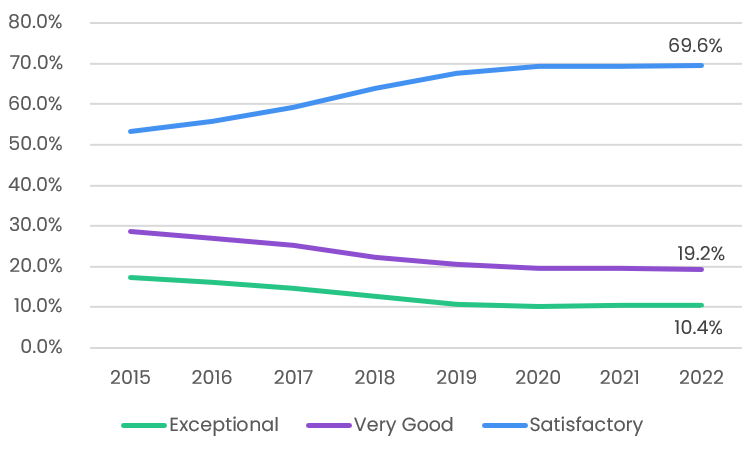

Ratings are Gradually Increasing

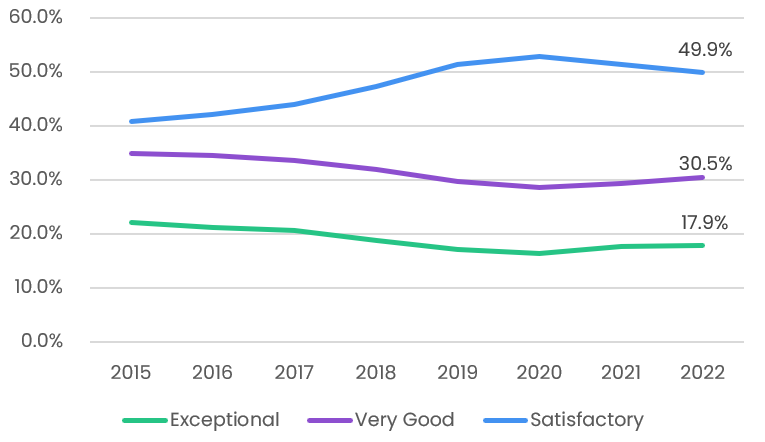

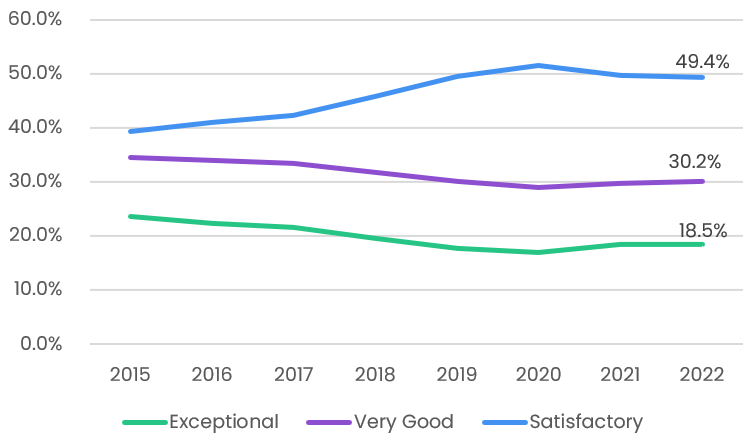

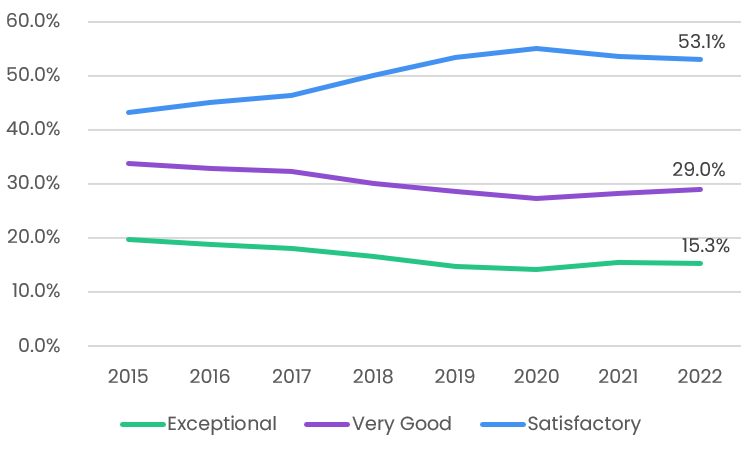

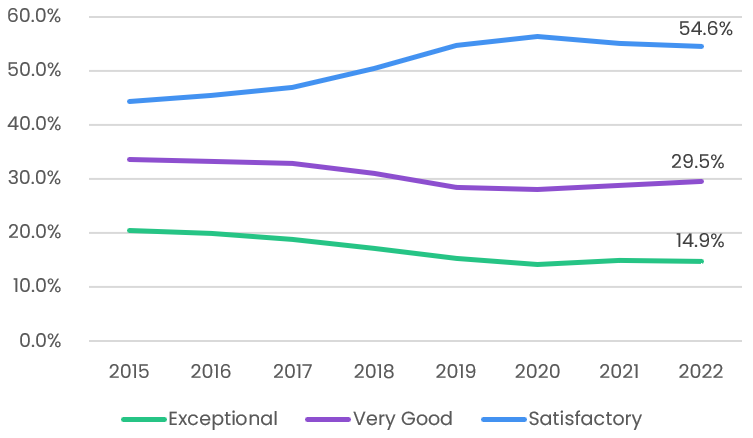

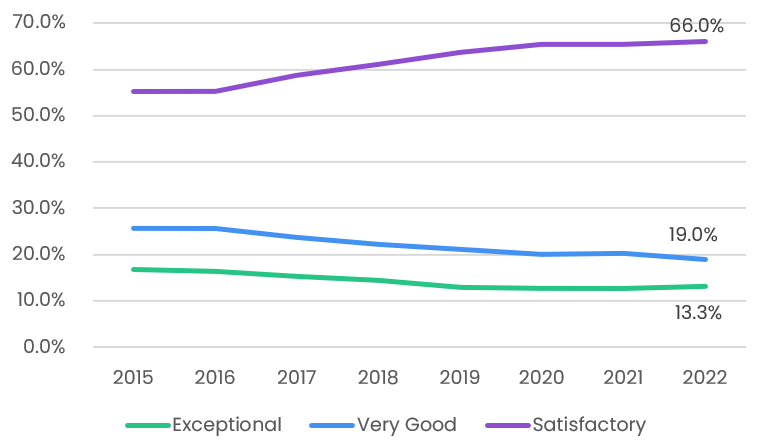

The number of Exceptional and Very Good ratings had been in decline for over a decade, making it more and more challenging for contractors to differentiate their performance. As shown below, in fiscal year 2021 and 2022 this trend began to moderate or reverse in many of the evaluation areas. Still with more than half of ratings being Satisfactory in many evaluation areas, Very Good and Exceptional ratings remain differentiators for the contractors receiving them.

Marginal and Unsatisfactory ratings remain extremely rare with fewer than 2% of contractors receiving either rating in each year since 2015.

Distribution of Ratings by Evaluation Area

Quality

Management

Schedule

Cost Control

Small Business Subcontracting

Regulatory Compliance

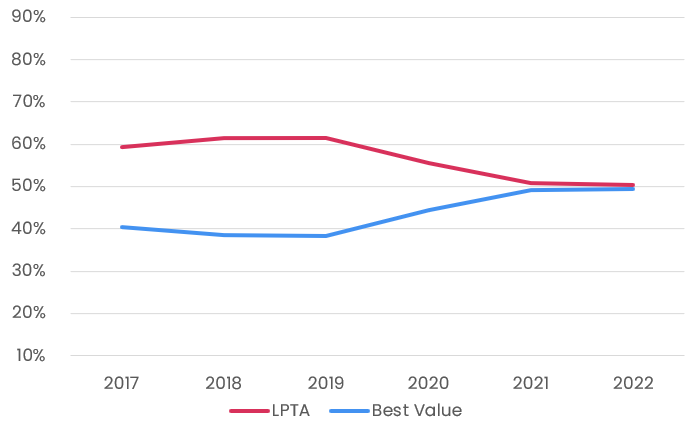

Why are average ratings increasing? While it is difficult to pinpoint a specific reason, one potential driver is a shift away from Lowest Price Technically Acceptable (LPTA) source selection, which became more common following sequestration in 2012, towards Best Value source selection following new rules limiting LPTA at the DoD implemented in FY 2020 and civilian agencies implemented in FY 2021.

Percent of Public Solicitations by Evaluation Criteria3

In Best Value solicitations, the awarded contractor is more likely to have won because they have a stronger ability to outperform, where in LPTA contracts, the contractor is selected primarily on price and ability to do a “Satisfactory” job. Best Value solicitations also benefit contractors that have historically received strong evaluations and are more likely to do so in the future.

The timing of the increase in CPARS ratings is closely aligned with the timing of the increase in Best Value selections. The correlation suggests that the government may be getting better work from contractors because of the rule changes. Since many contracts that require evaluations are 3-5 years in length, ratings may continue to see upward pressure as older contracts roll-off and newer ones start.

Distribution of Ratings

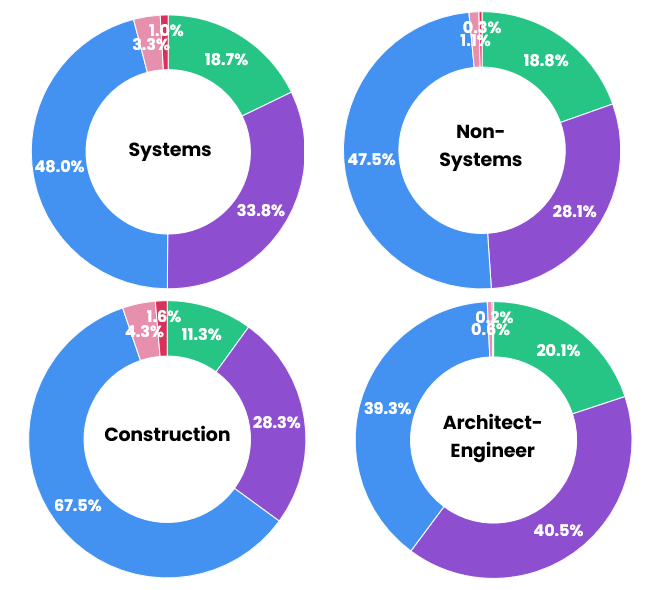

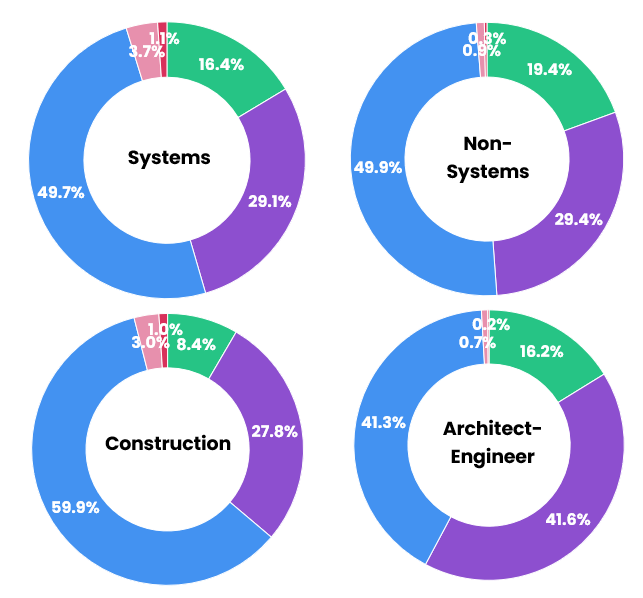

CPARS defines four business sectors including:

- Systems: Products that include significant engineering and development work including for aircraft, ground vehicles, ordinance, science and technology systems, shipbuilding, space, and training systems

- Non-Systems: Includes facilities services, management support services, repair and overhaul, transportation, information technology hardware and services, operations support, and non-systems science and technology

- Architect-Engineer: Includes professional services of an architectural or engineering nature

- Construction: Includes the construction, alteration, or repair of buildings, structures, or other real property

While the defined business sectors are very broad, the distribution of ratings varies meaningfully between the sectors, with a wider variation in ratings in the Systems and Non-Systems categories versus Construction and Architect-Engineering.

Thus, when benchmarking evaluations, it is important to consider the relevant category and compare accordingly.

Business Sector Split by Management Rating

Business Sector Split by Quality Rating

Improving Ratings and Leveraging for Growth

Proactively Provide Data and Feedback

Providing an agency customer with specific data demonstrating success on a contract early and through the contract term can support strong performance evaluations. In the event that a contractor receives an unfavorable rating, it has 14 calendar days from the date of notification to submit comments or provide additional information. By engaging the agency, it may be able to correct any inaccuracy or negotiate a revised rating.

Request that an Evaluation is Completed

As of the end of FY 2022, there were 49,638 overdue evaluations (including many never completed from prior years). While this makes up a relatively small percentage of total evaluations, it is important to ensure ratings are completed so that the feedback can be leveraged to improve performance and to support marketing efforts.

Benchmark Scores Against the Competition

Comparing a contractor's evaluations against averages in the relevant category can be a useful signal about their historical performance and ability to win work. As Very Good and Exceptional ratings remain relatively rare, they can be meaningful differentiators if received consistently. If a contractor ranks below the average, it should consider taking steps to improve its ratings.

Advertise Above-Average Ratings

If ratings are above average for a business sector, contractors can use this fact in marketing and proposals and when working with potential prime contracting partners.

Formally Challenge Problematic Ratings

In the event of an unfavorable or unfair evaluation, a contractor can submit a claim challenging the evaluation. If the claim is denied, the contractor can appeal the denial to the Board of Contract Appeals or Court of Federal Claims. There are a number of law firms with experience in assisting contractors in formally appealing unfair evaluations.

Author

Justin SikenFounder of HigherGov

justin.siken@highergov.com

Sources

HigherGov, CPARS, SAMNotes

1. CPARS provides public statistics only on a system life-to-date basis. The calculations in this report use annual averages based on year-over-year changes. All years are government fiscal years ending September 30.2. Analysis includes mentions of the Past Performance Information Retrieval System (PPIRS), a legacy system that was fully merged into CPARS in 2019.

3. Based on HigherGov analysis of the evaluation criteria mentioned in public solicitations posted to SAM.GOV.