Special Report | January 11, 2023

Aerospace, Defense, and Government M&A Review

Robust acquisition activity continued in 2022 despite hangover from prior year and economic headwinds

Key Takeaways

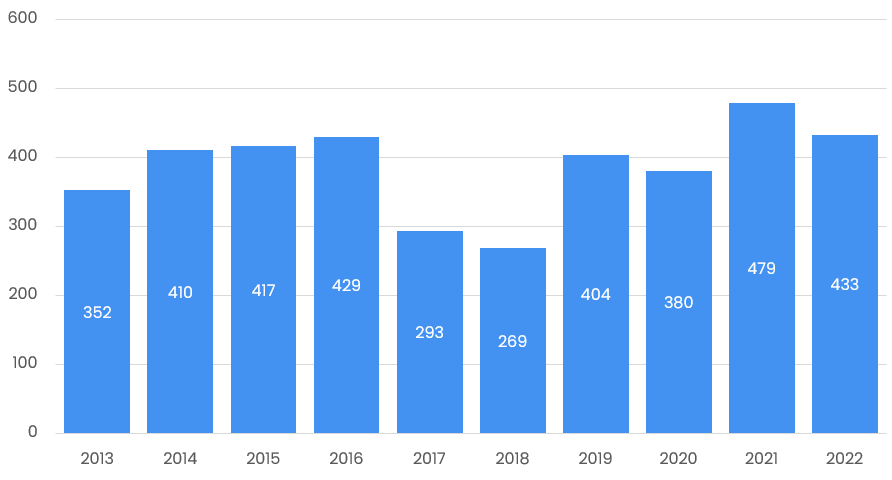

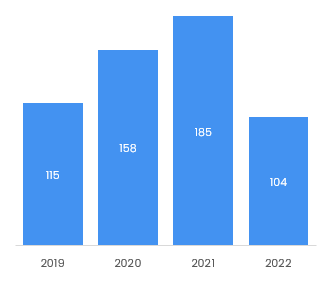

- There were 433 Aerospace, Defense, and Government (ADG) transactions in 2022, the second greatest number of transactions ever, down 10% from record 2021

- The Defense Products and Services sector experienced a 12% increase in transactions, driven by defense spending in the U.S. and Europe to counter expanding nation-state threats

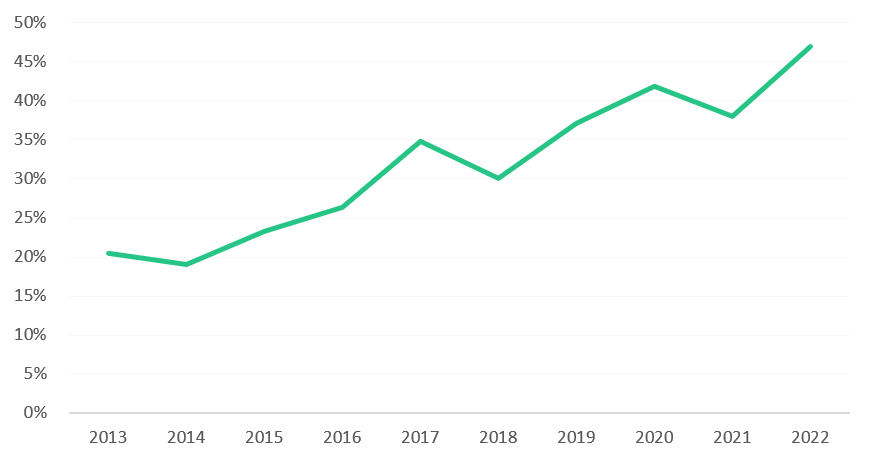

- Private Equity has become a driving force in the ADG market after years of persistent growth and now accounts for 47% of transactions and 41% of deal value

- Space and cybersecurity, once niches in ADG, are now major pillars of the sector and transaction volume

- Enduring geopolitical threats, resilient company cashflows, and continued investment in critical technologies will support ADG transaction volumes in 2023 despite macroeconomic headwinds

2022 M&A Trends

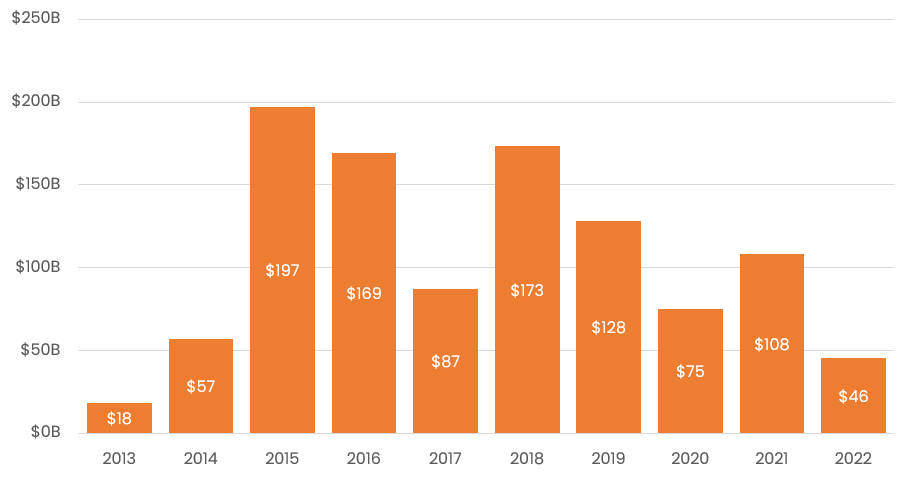

433 transactions were announced in the ADG M&A market in 2022. This was down from the all-time high in 2021 of 479 transactions, but still the second greatest number of transactions ever, despite broader macroeconomic headwinds including higher inflation and rising interest rates. Larger transactions were more heavily impacted by market trends with the total disclosed deal value declining from $108 billion in 2021 to $46 billion in 2022.

10 Year Transaction Volume Trend (Count)

Factors Driving Pullback in Transaction Volumes

Some of the 2022 decline can be attributed to a normalization following a very robust level of activity in 2021 as strategic and financial buyers completed transactions postponed due to COVID-19 in 2020, buyers took advantage of low interest rates, and private equity firms worked to catch-up on capital deployment goals.

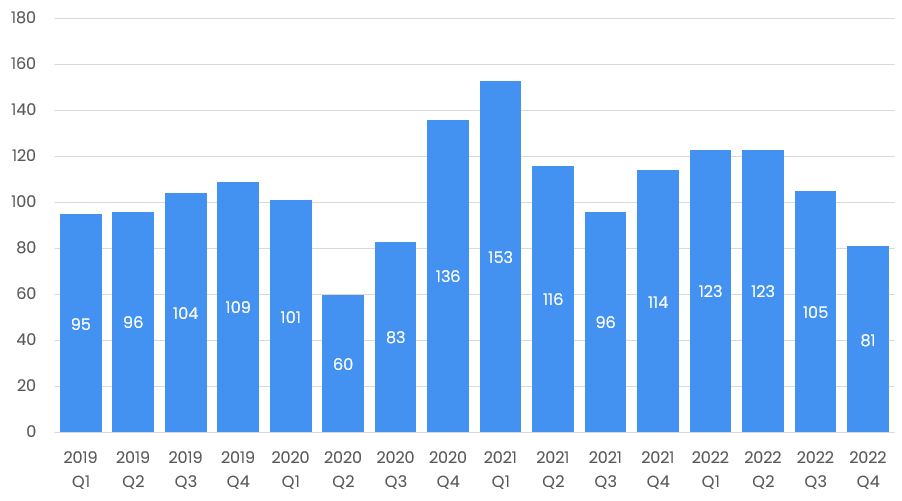

The slowdown in deal activity accelerated in Q3 and Q4 as a sharp rise in interest rates significantly increased borrowing rates for acquirers. Higher borrowing rates have made financing large transactions more expensive, forcing buyers to either finance more of a transaction in cash or abandon large takeovers.

Moreover, the government’s opposition to Lockheed Martin’s acquisition of Aerojet Rocketdyne, the Department of Justice’s attempt to block Booz Allen Hamilton’s ultimately successful acquisition of EverWatch, and the Department of Defense's increasing concern regarding the state of competition among government contractors and the depth of the defense supply base is complicating the calculus of large M&A transactions.

Mirroring market-wide trends, the number of announced Special Purpose Acquisition Company (SPAC) acquisitions in the ADG market plummeted from 12 in 2021 to just six in 2022. Given the rapid drop in the number of new SPACs and the abandonment or delayed close of several transactions (such as Breeze Holdings and D-Orbit calling off their merger), we expect that this trend will persist.

Quarterly Transaction Volume Trend (Count)

Smaller Strategic Transactions Dominate Volume

There was a sharp increase in the number of small and medium sized transactions in 2022. The number of companies with fewer than 50 employees that were acquired increased from 250 to 282. The robust volume in smaller transactions was driven by add-ons at private equity platforms (140 in 2022 vs 103 in 2021) and divestitures (59 in 2022 vs 51 in 2021) as companies engaged in capability shaping. It also mirrors changes across the broader M&A market where both private equity and strategic buyers increasingly acquire companies earlier in the corporate lifecycle as they compete to obtain emerging technology and capabilities.

On the larger side of the market, the total number of transactions with an enterprise value of greater than $1 billion decreased from 27 in 2021 to 10 in 2022. Larger transactions were more likely to be impacted by higher interest rates (given the greater need for debt) as well as DoD consolidation concerns and the pull-back in the SPAC market.

10 Year Transaction Volume Trend ($ Billions)

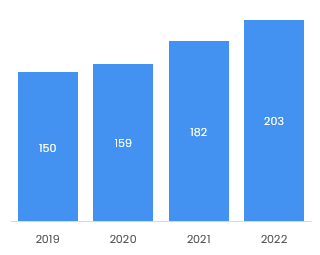

The Rise and Rise of Private Equity

Discussion of the increasing role of private equity involvement in the ADG sector has been growing for more than two decades. In 2022, however, private equity activity in the sector approached 50% of total transactions, with 203 transactions completed by nearly 90 different private equity firms, up from 182 transactions in 2021. The majority of these private equity transactions (140) were add-ons to existing platforms as investors pursued “buy-and-build” strategies. As private equity involvement in the sector matures, there is also a growing number of private-equity to private-equity transactions with 25 in 2022 up from just 11 in 2020. Private equity is also responsible for an increasing share of transaction value, making up 41% of the market in 2022 versus 27% in 2021.

The relative stability of government contractors through several economic cycles has increased investors’ appetite for the sector and swollen the number of funds and fund sizes for investors focused in the sector (such as Arlington Capital Partners targeting $3.5 billion for its next fund), particularly in the middle-market. Private equity has grown increasingly sophisticated in understanding set-asides and helping contractors manage the transition away from small business, increasing their involvement in smaller contractors that were once avoided.

Additionally, the growing intersection of government and broader technology trends in areas such as space and cyber is drawing investment from private equity firms that have not historically invested in the sector. Moreover, while some investors had traditionally avoided defense contractors that produced kinetic weapons due to potential reputational risk, the increasing prevalence of cyber defense, surveillance, and other non-kinetic products and services has opened more funding to the defense market.

Share of ADG Acquisitions Made by Private Equity

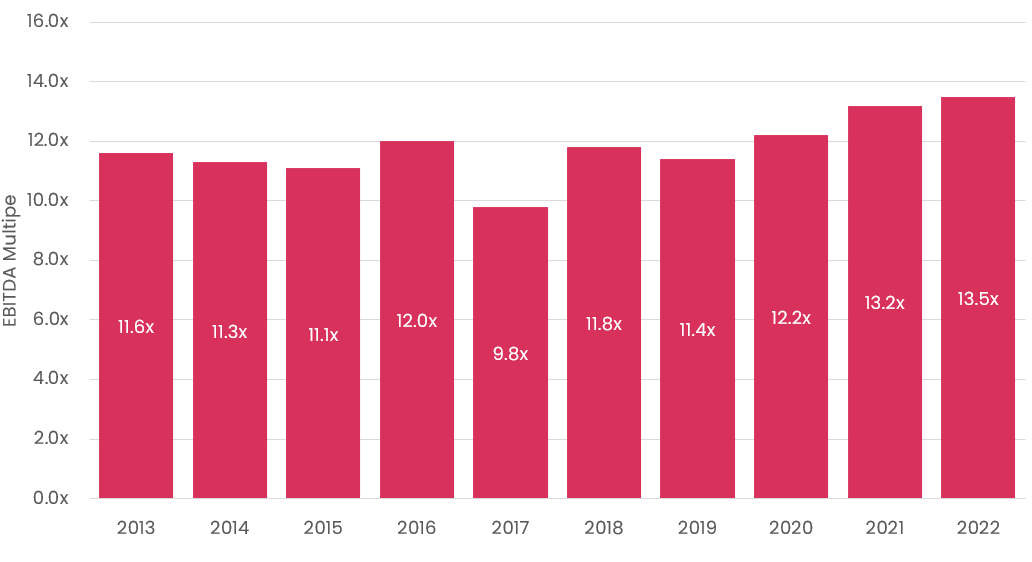

EBITDA Multiples Reach All-Time Highs

Higher interest rates often portend lower valuations; however, disclosed transaction multiples in the ADG market have remained robust given predictable cash-flows and increased defense spending. The median trailing 12-month EBITDA multiple for the year was 13.5x, an all-time high. M&A multiples in the sector have remained remarkably consistent except for dips in 2012 due to sequestration and in 2017 due threats of civilian agency budget cuts.

Notable high-multiple transactions for the year included Carlyle’s acquisition of ManTech (15.9x EBITDA), TTM Technologies’ Acquisition of the Telephonics division of Griffon Corporation (16.1x EBITDA) and QinetiQ’s acquisition of Avantus Federal (16.6x EBITDA).

10 Year Median EBITDA Multiple Trend

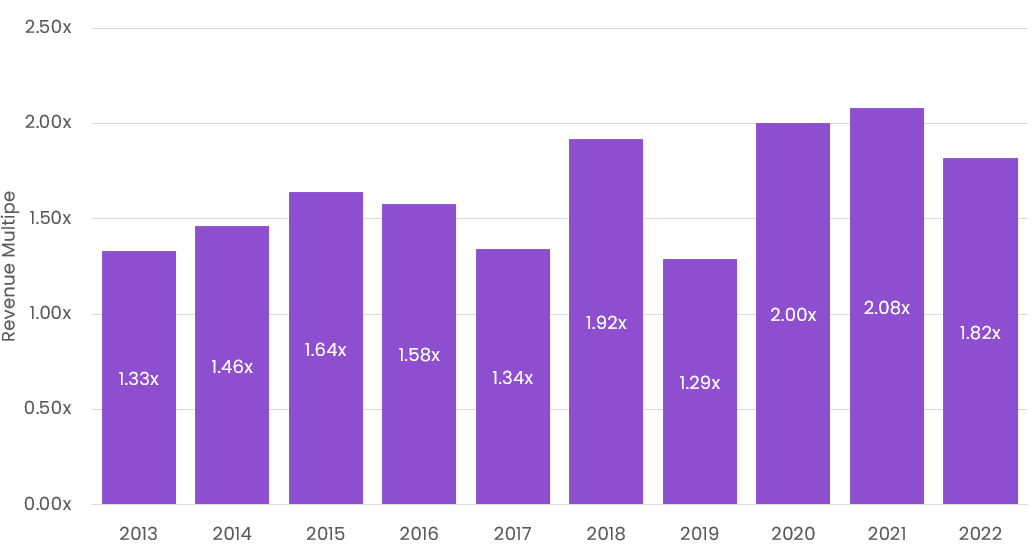

While much less commonly used as a valuation metric in the sector, median revenue multiples declined for the year from a median of 2.1x in 2021 to 1.8x in 2022.

10 Year Median Revenue Multiple Trend

Notable Sector Trends

Defense Products and Services

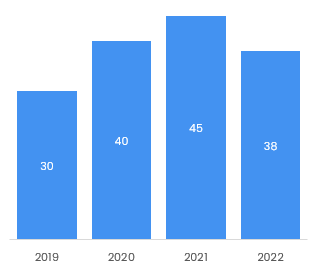

Defense Transaction Trend

The Defense sector experienced strong growth from 182 to 203 transactions with activity focused on companies with unique IP or customer access and a continued focus on innovative defense electronics, electronic warfare, data gathering, artificial intelligence, modeling and simulation, and other technologies that provide the U.S. and European allies with a strategic advantage.

While few acquirers directly referenced the war in Ukraine and increasing tensions in Southeast Asia in their deal rationales, there was a clear solidification of the ongoing shift away from products supporting anti-terror and asymmetric warfare towards contractors that support major defense platforms, kinetic weapons, and advanced technologies such as hypersonics across the supply chain (for example, L3Harris' proposed acquisition of Rocketdyne, Rheinmetall's acquisition of EXPAL Systems, and Kratos Defense's acquisition of Southern Research Engineering Division).

Private equity roll-up strategies also contributed significantly to defense transaction volumes, as companies such as Arcline Investment Management’s Fairbanks Morse Defense made three separate acquisitions in 2022.

Commercial Aerospace Products and Services

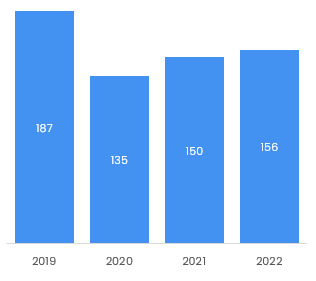

Commercial Aero Transaction Trend

Commercial Aerospace transaction volume continued to rebound from 2020. As the sector recovers from COVID-19, pre-COVID trends of OEMs and Tier 1 suppliers encouraging lower-tiered suppliers to consolidate and vertical integration strategies are returning. Meanwhile, suppliers are looking to diversify their customer and aircraft platform exposure, as well as expand capabilities to increase their value proposition to OEMs and airlines (for example, Transdigm's acquisition of DART Aerospace and HEICO's acquisition of Exxelia International).

As with the defense sector, aerospace volume was supported by private equity roll-up strategies, with for instance, KKR's Novaria Group announcing five acquisitions and Greenbriar Equity Group’s PCX Aerosystems announcing four acquisitions during 2022.

Government IT Services

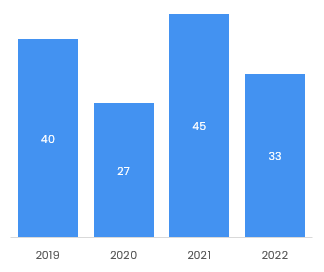

Government IT Transaction Trend

Government IT Services volume declined from 185 transactions in 2021 to 104 transactions in 2022. The slowdown reflects record volumes in 2020 and 2021 with aggressive consolidation and founder exits. Given the significant consolidation in the IT Services market over the past several years, a slow-down is unsurprising. The IT market may also have been impacted by a shift in investment towards the defense products and services sector.

As in recent years, the strongest demand was for technology that supports mission-critical national security programs (such as Carlyle's acquisition of ManTech) and contractors that can provide IT modernization and digital transformation (such as IBM's acquisition of Octo Consulting).

Given that federal government agencies continue to face significant technology skills shortages, pressure to reduce legacy IT costs, and demand for faster and more robust citizen services, we expect volume will remain strong in the long-term.

Space

Space Transaction Trend

While down from the prior year, Space M&A remained active as consolidation in the sector continued and incumbents looked to acquire new capabilities. The space sector has benefited from dramatic improvements in electronic systems and launch services that enable a rapidly expanding array of space-based capabilities. Volume decreased from its peak in 2021, especially in suppliers for commercial space applications, as excitement from the first privately-developed spaceflights with private citizens waned.

The year was dominated by the acquisition of companies supporting Geospatial Intelligence (such as Antarctica Capital’s acquisition of Descartes Labs and Advent International’s pending acquisition of Maxar Technologies), Satellite Communications (such as Eutelsat’s acquisition of OneWeb Global), and propulsion systems (such as L3Harris' pending acquisition of Aerojet Rocketdyne).

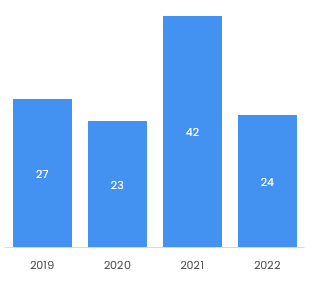

Government Cybersecurity

Cyber Transaction Trend

Like Space, government cybersecurity saw a modest decrease in transaction volume in 2022 from the prior year, though levels remain well above those seen 5-10 years ago. While pure-play cyber transactions declined, cyber capabilities remained in high demand, and the acquisition of cyber capabilities played a role in many broader IT Services acquisitions during the year such as Carlyle's acquisition of ManTech.

Companies with unique IP and strong services portfolios focused on intrusion detection and mitigation, zero-trust, and offensive and defensive cyber training were in the greatest demand (for example, Western Acquisition Ventures' planned acquisition of Cycurion and Mission Critical Partner's acquisition of Secure Halo).

Government Health

Health Transaction Trend

Health saw the largest percentage decrease in volumes in 2022 versus 2021 as the market stabilized and spending from COVID-19 decreased. This decline in the government market mirrored a significant slowdown in volumes in the commercial healthcare market.

Companies that provided modernization or oversight software and services continued to see demand in the government health sector (for example, ICF International’s acquisition of SemanticBits, Unison’s acquisition of Plan4 Healthcare, and CNSI’s acquisition of Kepro).

2023 Outlook: Activity Likely to Remain Robust

Increased Global Defense Spending Will Overcome Macroeconomic Headwinds

Higher defense spending at a global and national level will support a robust level of M&A activity. The U.S. Congress authorized an 8% increase in the defense budget over 2022 levels with the FY 2023 National Defense Authorization Act adding $45 billion to the defense budget proposal made by the White House.

Additionally, the ongoing conflict in Ukraine and the resulting increases in defense budgets may encourage a more consolidated and partnership-focused approach within the relatively fragmented European defense industry.

DoD Limits on Consolidation Will Affect the Market Unevenly

The Pentagon's reluctance to support further consolidation is likely to restrict the number of large-scale deals, but will not likely have a significant impact on the middle market. While the U.S. government has made it clear that it does not support large-scale consolidation, smaller manufacturers and suppliers are less likely to face the same level of scrutiny.

While historically the government's consolidation concerns have been primarily focused on products, given the rapid consolidation in the services market, we do expect to see growing scrutiny here.

Predictability of Sector to Support Volume in Event of Recession

The multi-year nature of many government and commercial aerospace contracts gives companies in the sector reliable and predictable cash flow that is attractive to investors during economic downturns. While macroeconomic pressures including higher inflation and interest rates drove a decrease in volumes in Q3 and Q4 2022, we expect that volumes will likely rebound in 2023 (though possibly at lower valuations) as inflation and rate increases moderate while sector dynamics remain positive.

Space and Cyber Will Remain Key Acquisition Areas

Although activity in the space and cyber sectors may have reached their short-term peak, we anticipate activity in these sectors to remain strong. Economic challenges may impact the ability of some space and cyber start-ups to secure funding, but most companies will likely successfully weather an economic downturn.

The military is also showing strong interest in the space sector, with the US Congress directing military personnel to collaborate more closely with the private sector. In addition, the recent release of the DoD’s Five Year Zero Trust Roadmap will place increasing focus on the acquisition of companies that can help agencies achieve these goals.

A Good Time to be a Seller and to be a Buyer (with Cash)

While the environment has weakened over the past several months, we expect the market to remain favorable to sellers given record valuation multiples and strong demand from strategic buyers and private equity firms with significant dry powder. Smaller companies and those with differentiated intellectual property or capabilities will have the easiest time completing transactions.

For buyers, strong defense spending in the United States and Europe and strengthening air passenger numbers will make ADG an attractive market in a time when many other industries have been negatively impacted by inflation and tightening corporate budgets. Buyers with cash will be best positioned as debt costs will likely to remain elevated at least through 2023.

Largest 2022 Announced ADG Transactions

- Advent International acquisition of Maxar Technologies ($6.4 billion)

- Apollo, J.F. Lehman & Company, and Hill City Capital acquisition of Atlas Air Worldwide ($5.2 billion)

- L3Harris Technologies acquisition of Aerojet Rocketdyne ($4.7 billion)

- Carlyle Group acquisition of ManTech ($4.2 billion)

- Eutelsat acquisition of OneWeb Global ($3.4 billion)

- Combination of Vectrus and Vertex Corporation ($2.1 billion)

- L3Harris Technologies acquisition of the Tactical Data Links business of ViaSat ($2.0 billion)

- WSP Global acquisition of the Environment & Infrastructure Business of John Wood Group ($1.8 billion)

- Veritas Capital acquisition of Chromalloy ($1.6 billion)

- Singapore Airport Terminal Services acquisition of Worldwide Flight Services ($1.1 billion)

Author

Justin SikenFounder of HigherGov

justin.siken@highergov.com

Sources

HigherGov, company press releasesNotes

1. Transactions can be classified into more than one sector2. Transaction multiples are calculated on a Last-Twelve-Month (LTM) basis as available and exclude the value of estimated tax assets and synergies