SBIR Benefits Go Beyond the Award

HigherGov03/23/2023

HigherGov

Key Takeaways

- The total value of Phase I and II SBIR/STTR awards exceeded $4.3 billion in government fiscal year 2022

- Our analysis shows that small businesses of all sizes are able to compete effectively for SBIRs, but size provides a benefit in advancing to Phase II

- There are long-term benefits to SBIR awards – recipients are more likely to remain active in government contracting and to grow faster

- Being proactive in searching for and pursuing SBIRs can increase an organization’s odds of winning

Overview of the SBIR/STTR Programs

The Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Programs are federal programs designed to encourage and support small businesses in the development of innovative technologies. These programs provide funding for research, development and commercialization of products, services, or processes that have potential for commercial success. The SBIR and STTR programs collectively represent the largest source of early-stage research and development funding for small businesses in the United States.

For the government, these programs provide agencies with an opportunity to invest in innovative technology solutions while also helping to foster economic growth through small business development initiatives.

For recipients, these programs offer companies capital to develop new products and services without having to give up equity or take on debt and to establish critical relationships with government agencies. Recipients typically retain intellectual property rights of data and technology developed using SBIR/STTR funds, though they must provide a license for government use. This government-funded research and development can be especially valuable for young companies that have limited access to other financing.

To be eligible for the SBIR/STTR programs, a small business must be a for-profit business based in the United States with fewer than 500 employees.

The SBIR/STTR programs are divided into three phases:

- Phase I: Applicants submit a proposal outlining their proposed project which is evaluated by the sponsoring agency. If selected, applicants receive up to $250 thousand in funding to develop a prototype or proof-of-concept.

- Phase II: Successful applicants from Phase I can receive up to $1 million in funding to further refine the prototype or concept with an emphasis on marketability and commercialization potential.

- Phase III: Awardees are encouraged to seek private sector investment or venture capital funding as they transition their product into the marketplace. In some cases, Phase III can include non-SBIR contracts from the government for continued development or for production. These contracts can range into the tens of millions of dollars.

Trends in Phase I and Phase II SBIR/STTR Awards

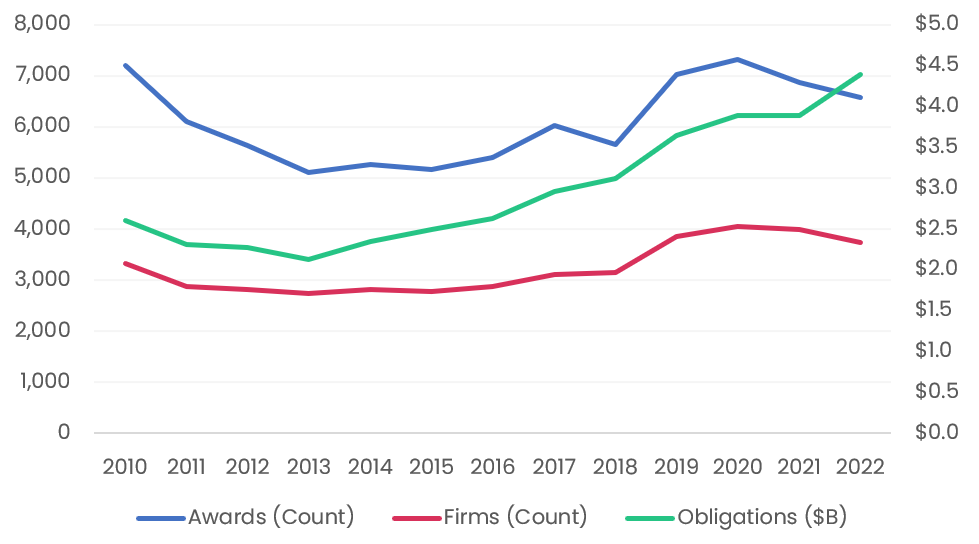

Phase I and Phase II SBIR/STTR Awards and Obligations by Year

HigherGov Analysis

HigherGov Analysis

The total value of SBIR and STTR awards has gradually increased over the past 10 years and exceeded $4.3 billion in government fiscal year 2022 spread across more than 6,000 awards and approximately 3,700 different awardees. SBIR awards accounted for approximately 3% of the $159 billion awarded to all small businesses by the federal government in 2022.

Congress recently reauthorized the SBIR and STTR Programs through government fiscal year 2025. The reauthorization contains provisions that aim to reduce the number of or companies that have won dozens of Phase I SBIR awards (commonly called “SBIR Mills”), which may result in an even wider number of firms receiving awards in the future.

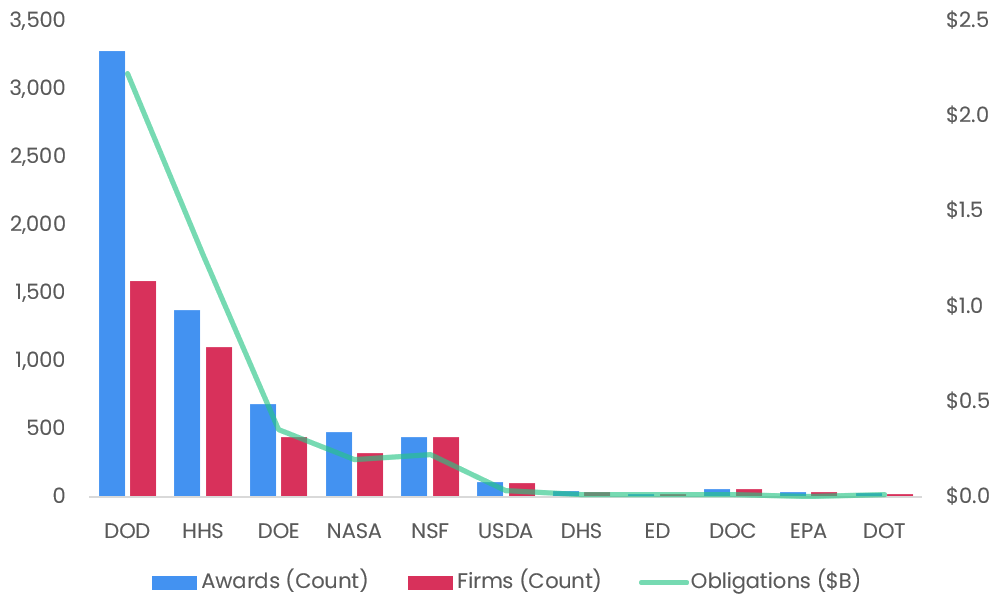

Phase I and Phase II SBIR Awards and Obligations by Agency in 2022

HigherGov Analysis

HigherGov Analysis

SBIR funding is highly concentrated, with the Department of Defense (DoD), the Department of Health and Human Services (HHS), and the Department of Energy (DOE) accounting for approximately 90% of all SBIR obligations in 2022. Within the Department of Defense, the Air Force accounted for approximately 45% of obligations, the Army and the Navy accounted for approximately 20% each, and the Missile Defense Agency and DARPA made up the majority of the remainder.

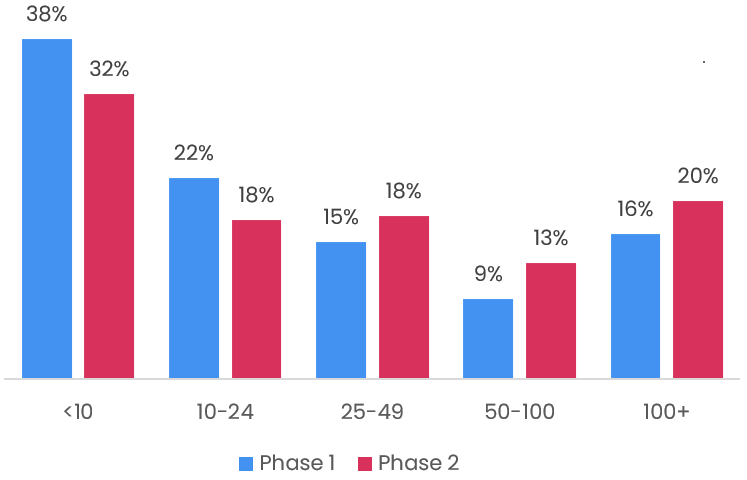

Percentage of Firms Winning Phase I or Phase II Awards by Number of Employees in 2022

HigherGov Analysis

HigherGov Analysis

Firms all of sizes are able to compete effectively for SBIRs with approximately 38% of all Phase I awards in 2022 going to firms with fewer than 10 employees and at least 40 firms with only one employee winning a Phase I award. However, larger companies are generally more successful at converting awards to Phase II.

SBIR/STTRs can be a meaningful way for companies with limited experience in the government market to either enter or grow their business. The median organization receiving a SBIR/STTR award had $1.1 million in federal government obligations in 2022 (including the SBIR/STTR awards themselves) and approximately 60% of awardees had no other federal contract obligations during the year.

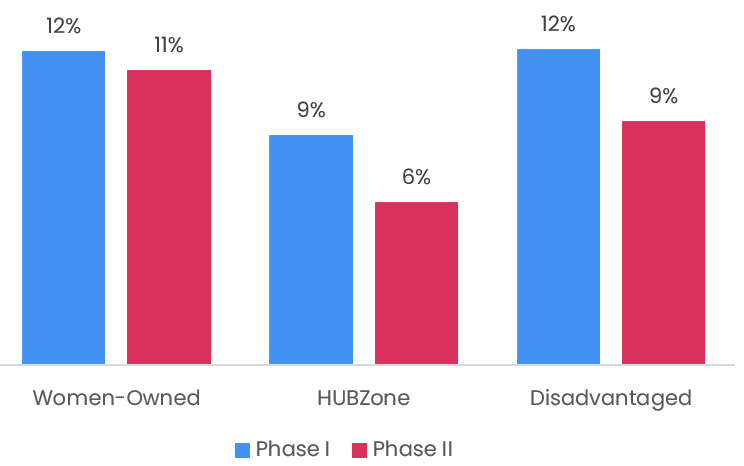

Percentage of Phase I or Phase II SBIR/STTR Awards by Socioeconomic Group in 2022

HigherGov Analysis

HigherGov Analysis

Women-owned, HUBZone, and Disadvantaged small businesses all win a greater share of Phase I SBIRs than they do overall government contract awards, but a smaller share than they do of all small business awards.

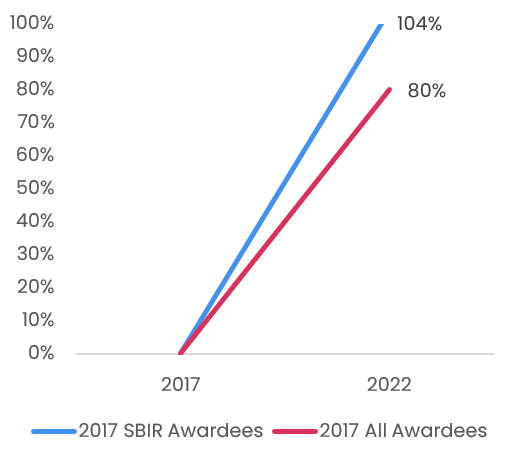

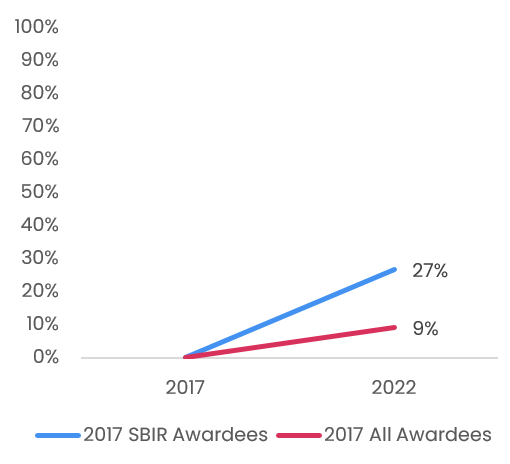

5 Year Obligation Growth at Awardees Receiving Phase I or II SBIR/STTRs Awards vs All Awardees

Average Growth

Median Growth

Companies that win SBIR/STTR awards outperform the average government contractor in the long-term. Looking at companies that received SBIR/STTR awards in 2017, on average more of them were still involved in federal contracting in 2022 than all contractors in 2017 (50% vs 44%), and for those SBIR/STTR awardees that still sold to the federal government, their average and median growth rates were meaningfully higher.

This suggests that either (1) the experience from applying for and winning the award, the relationships developed with agencies, and/or the intellectual property developed help to support long-term growth or (2) that companies that are investing in research and development are more likely to experience above-average growth. We believe it is likely a combination of both of these forces.

Of course, for companies that successfully reach Phase III, SBIRs can be highly lucrative as several recent awards potentially worth more than $10 million to Progeny Systems, Area-I, and Beast Code demonstrate.

Recommendations for Winning Awards

Pursuing and winning a SBIR can be a daunting prospect. Below are some recommendations for crafting proposals and winning:

- Monitor For New Opportunities. HigherGov tracks SBIR opportunities from solicitation through award. The Small Business Administration also maintains a current list of opportunities as well as a release calendar.

- Talk to the Program Manager. While SBIR program managers are not permitted to provide guidance on what to include in a proposal, they can help to interpret parts of a solicitation and may provide some context as to whether a proposed project is likely to be a strong fit. A conversation can also give some indications of specific areas a proposal should give particular weight to and to potential areas of weakness.

- Build a Strong Team. Adding subcontractors or consultants to a team can add depth and experience to fill any gaps in capabilities or to differentiate a proposal. HigherGov’s Contract and Grant Award searches and Awardee Ranking tool can be used to find awardees with experience with similar SBIRs or other technology contracts that would make potential valuable additions to a team.

- Write to the Review Criteria. Every agency has its own criteria for evaluating proposals. Strong proposals will carefully address each proposal factor and avoid common issues such as not presenting an original idea, not demonstrating relevant experience, proposing an infeasible level of work for the timeline, or not demonstrating commercial impact.

- Find Help. Crafting a SBIR proposal can be a time-consuming and intimidating process, but there are many resources available to help. The SBA maintains a list of resources and has a useful set of tutorials on the proposal process.

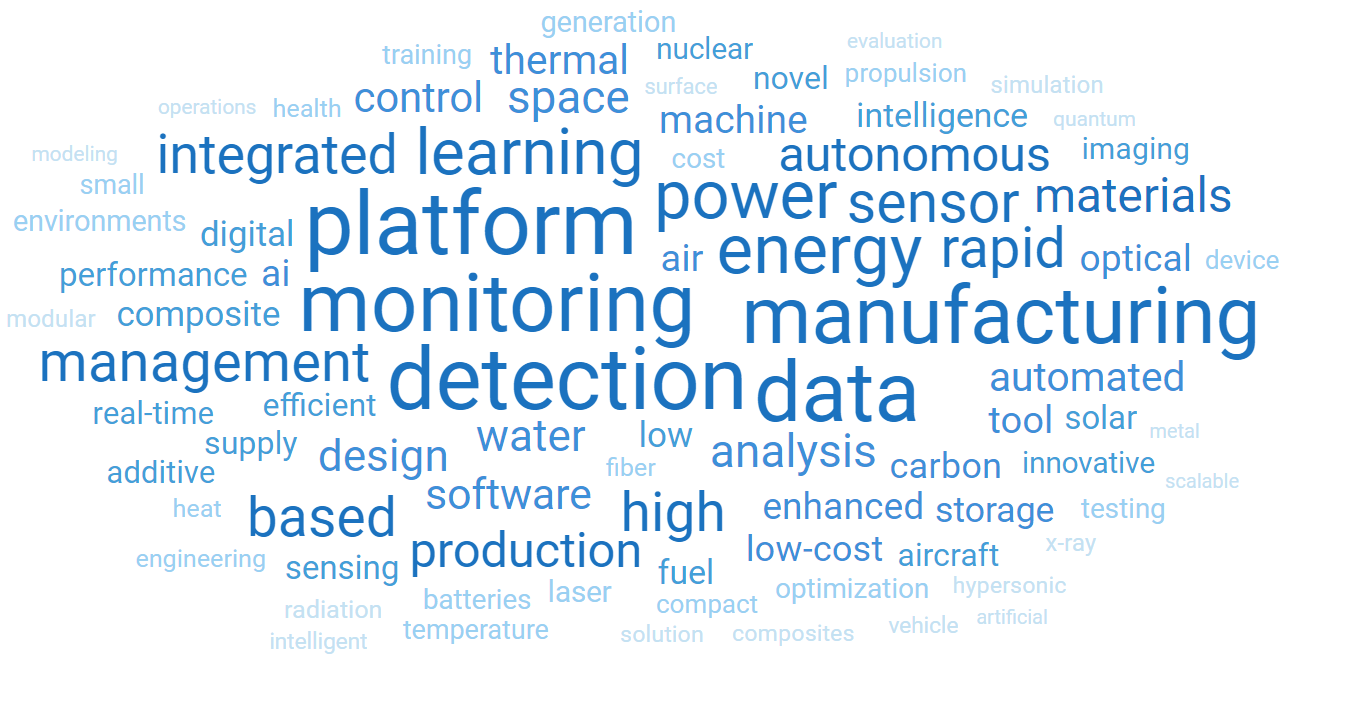

- Target Popular Areas. Pursuing topic areas where there is more money and where an organization can differentiate itself can greatly increase the odds of winning. For example, given the concentration of money within the DoD, HHS, and DOE, it can make sense to focus primarily on these agencies unless a company has a strong existing presence or unique experience applicable to other agencies. Moreover, in any given year, there tends to be popular areas for research across agencies. Focusing on these trends can allow a company to leverage proposal ideas across solicitations at multiple agencies.

Word Cloud of Recent SBIR/STTR Abstract Titles

HigherGov Analysis

HigherGov Analysis

Author

Justin Siken

Founder of HigherGov

justin.siken@highergov.com

LinkedIn

Notes on Methodology

This analysis is based on data provided by SBIR.gov except for average awardee obligations and 5-year growth data, which is based on contracts flagged as SBIR or STTR awards in FPDS (this analysis excludes SBIR/STTRs structured as grants). 2022 SBIR award numbers throughout are still listed as preliminary by SBIR.gov and may be updated.

Data Sources

HigherGov Analysis, Federal Procurement Data System, SBIR.GOV